To decorate the bottles, manufacturers grind these special glasses together with inorganic pigments, print them as pastes on the base glass and melt them on. As a result, the colors are just as durable as the glass itself. Beer mugs, baby bottles and pharmaceutical glass products, such as vials, are decorated and labeled in about like the perfume bottles are. In the future, a new EU Directive will banish the potentially unhealthy lead oxide from the logos. But this is far from simple: in order for the printing inks to hold permanently, they have to be made of chemically resistant glass. However, they usually contain a lot of silicon dioxide, and therefore have to be melted above 1600 degrees Celsius -- a temperature that the base glass would not withstand without becoming deformed. The added lead oxide lowers the melting temperature to below 600 degrees Celsius, thereby creating viable processing conditions. As a last resort, manufacturers are replacing the lead oxide with bismuth oxide. However, that, too, is problematic: Bismuth is dangerous to one's health as well as to the environment. It also multiplies the price of the imprints. Colorful decor without pollutants A new development by researchers at the Fraunhofer Institute for Silicate Research ISC in Wurzburg and the Forschungsgemeinschaft Technik und Glas e.V. FTG can change that. "We have developed lead oxide free decorative paints, which do perfectly well without toxic substances," says Anika Deinhardt, researcher at the ISC. "They are easy to process, have high color brilliance and are chemically resistant. In addition, they do not contain any rare or expensive elements." The basis of these novel decorative paints is a glass that consists mainly of zinc oxide. Further constituents are aluminum oxide, boron oxide and silicon dioxide. The researchers gave this basic glass system -- almost as a short form of all the elements -- the name ZABS. Zinc oxide ensures that this glass already melts below 650 degrees Celsius. It therefore takes over the task that previously fell to the lead oxide. "Through various other additives, we are able to modify ZABS further and adapt it very well to the respective requirements," explains Deinhardt. As a result, the scientist and her colleagues were able, for example, to reduce the melting temperature of a special glass to 580 degrees Celsius. In a further step, they are working to produce glasses with a processing temperature of only 540 degrees Celsius. At glasstec, they will present their work, along with samples (Hall 15, Booth A33). As the glass, so the decorative color Another point which the scientists have to consider: The industry partners use different types of glass for their products. If the glasses are heated, they expand at different rates -- experts speak here of the thermal expansion coefficients (TEC) for the respective glass. In order for the imprints to not flake off, they have to expand similar to the glass on which they are applied. This already works for soda-lime glass, from which drinking glass and container glass are made, for example. The researchers hope that in six months, they will also have adapted the new colors to borosilicate glass, from which vials, laboratory glassware and household goods, such as casserole dishes or tea and coffee pots, for example, are made. On behalf of the Forschungsgemeinschaft Technik und Glas e. V. FTG, the Fraunhofer researchers are developing a catalog of all the developed low-melting glasses and their properties.

To decorate the bottles, manufacturers grind these special glasses together with inorganic pigments, print them as pastes on the base glass and melt them on. As a result, the colors are just as durable as the glass itself. Beer mugs, baby bottles and pharmaceutical glass products, such as vials, are decorated and labeled in about like the perfume bottles are. In the future, a new EU Directive will banish the potentially unhealthy lead oxide from the logos. But this is far from simple: in order for the printing inks to hold permanently, they have to be made of chemically resistant glass. However, they usually contain a lot of silicon dioxide, and therefore have to be melted above 1600 degrees Celsius -- a temperature that the base glass would not withstand without becoming deformed. The added lead oxide lowers the melting temperature to below 600 degrees Celsius, thereby creating viable processing conditions. As a last resort, manufacturers are replacing the lead oxide with bismuth oxide. However, that, too, is problematic: Bismuth is dangerous to one's health as well as to the environment. It also multiplies the price of the imprints. Colorful decor without pollutants A new development by researchers at the Fraunhofer Institute for Silicate Research ISC in Wurzburg and the Forschungsgemeinschaft Technik und Glas e.V. FTG can change that. "We have developed lead oxide free decorative paints, which do perfectly well without toxic substances," says Anika Deinhardt, researcher at the ISC. "They are easy to process, have high color brilliance and are chemically resistant. In addition, they do not contain any rare or expensive elements." The basis of these novel decorative paints is a glass that consists mainly of zinc oxide. Further constituents are aluminum oxide, boron oxide and silicon dioxide. The researchers gave this basic glass system -- almost as a short form of all the elements -- the name ZABS. Zinc oxide ensures that this glass already melts below 650 degrees Celsius. It therefore takes over the task that previously fell to the lead oxide. "Through various other additives, we are able to modify ZABS further and adapt it very well to the respective requirements," explains Deinhardt. As a result, the scientist and her colleagues were able, for example, to reduce the melting temperature of a special glass to 580 degrees Celsius. In a further step, they are working to produce glasses with a processing temperature of only 540 degrees Celsius. At glasstec, they will present their work, along with samples (Hall 15, Booth A33). As the glass, so the decorative color Another point which the scientists have to consider: The industry partners use different types of glass for their products. If the glasses are heated, they expand at different rates -- experts speak here of the thermal expansion coefficients (TEC) for the respective glass. In order for the imprints to not flake off, they have to expand similar to the glass on which they are applied. This already works for soda-lime glass, from which drinking glass and container glass are made, for example. The researchers hope that in six months, they will also have adapted the new colors to borosilicate glass, from which vials, laboratory glassware and household goods, such as casserole dishes or tea and coffee pots, for example, are made. On behalf of the Forschungsgemeinschaft Technik und Glas e. V. FTG, the Fraunhofer researchers are developing a catalog of all the developed low-melting glasses and their properties.

Souce http://www.sciencedaily.com/releases/2014/10/141013090233.htm

Beer and what festival? Finns remove "whisky" from expo name for fear of promoting drinking | Fox News

But it can't say it is. Authorities in Finland have ordered the "Beer and Whisky Expo Finland 2014" to change its name, arguing it violates Finland's law against advertising liquor. ADVERTISEMENT ADVERTISEMENT Organizers say next week's event will now be called simply a beer expo, since advertising mild alcoholic beverages such as beer and wine, is allowed. Chief organizer Mikki Nyman said Monday the decision "smacks of typical patronizing attitudes" of bureaucrats. Finland, known for its heavy drinkers, has a state-controlled alcohol monopoly. Jarmo Oresmaa, inspector at the regional state administrative agency which gave permission for the event, said Monday the original name of the expo advertised the drinking of whisky, which is illegal.

But it can't say it is. Authorities in Finland have ordered the "Beer and Whisky Expo Finland 2014" to change its name, arguing it violates Finland's law against advertising liquor. ADVERTISEMENT ADVERTISEMENT Organizers say next week's event will now be called simply a beer expo, since advertising mild alcoholic beverages such as beer and wine, is allowed. Chief organizer Mikki Nyman said Monday the decision "smacks of typical patronizing attitudes" of bureaucrats. Finland, known for its heavy drinkers, has a state-controlled alcohol monopoly. Jarmo Oresmaa, inspector at the regional state administrative agency which gave permission for the event, said Monday the original name of the expo advertised the drinking of whisky, which is illegal.

Souce http://www.foxnews.com/us/2014/10/13/beer-and-what-festival-finns-remove-whisky-from-expo-name-for-fear-promoting/

Waldorf-Astoria honey beer 'Waldorf Buzz' available now - am New York

Saved Enlarge Photo If Anheuser-Busch InBev can't grab the beer of its choice, it could settle for a Pepsi. With almost $90 billion in deals over the last 10 years, including the 2008 acquisition of the maker of Budweiser, no other beverage company spends like AB InBev does. Most of the speculation on the $170 billion beer behemoth's next move has focused on the industry's No. 2 brewer, London-based SABMiller. A company of A-B InBev's size and ambitions has other options though, including PepsiCo Inc. A-B InBev and its advisers have long studied whether a merger with the $142 billion soda and snacks company makes strategic and financial sense, said people familiar with the matter. However, no talks are happening now, no deal is imminent, and the scenario is among many it has looked at, one of the people added, asking not to be identified because the information is private. A-B InBev should think beyond the beer market, said Albert Fried & Co. That could put Monster Beverage Corp. or Keurig Green Mountain Inc., even further away from the brewer's core, on its radar. Either way, A-B InBev probably won't walk away empty-handed. The culture of A-B InBev is "really based on doing large deals, making big steps forward," Richard Withagen, an Amsterdam-based analyst at Kepler Cheuvreux, said in a phone interview. "It's all speculation what the next step will be. That there will be a next step seems pretty sure, given that I don't think this company wants to only manage the business and not expand it any further." Representatives for Leuven, Belgium-based A-B InBev, Purchase, N.Y.-based PepsiCo and London-based SABMiller declined to comment. Representatives for Corona, Calif.- based Monster Beverage and Waterbury, Vt.-based Keurig didn't respond to requests for comment. A takeover of SABMiller would be "boring," said Sachin Shah, a special-situations and merger-arbitrage strategist at Albert Fried. Regulators would likely force divestitures, and the cost savings from a combination wouldn't necessarily translate to increased value for shareholders, he said. "Why am I going to pay a higher multiple for more of a business that you're already in that's not necessarily growing?" Shah said by phone. "Anheuser-Busch should become a drinks business, rather than just alcohol and beer." A-B InBev and PepsiCo do know each other well, one of the people familiar with the matter said, citing the companies' bottling arrangement in Latin America. PepsiCo's soda and snacks businesses both hold appeal amid slowing profits in the beer space, the people said. Any deal between the two would have to be friendly. One driver for a takeover would be the potential cost and revenue benefits of selling beer and soft drinks through the same distribution system. A-B InBev and its Brazilian backers including 3G Capital billionaire Jorge Paulo Lemann could also improve profitability at PepsiCo like they did after purchasing Anheuser-Busch. Lemann and his two longtime business partners are holders of A-B InBev. "From a strategic perspective, it doesn't strike me as too, too crazy," Ali Dibadj, a New York-based analyst at Sanford C. Bernstein & Co., said by phone. "If you look at the strengths of ABI, they're very clearly around cost-cutting and distribution, particularly in a difficult volume environment like beer. I think those could be translated pretty directly to the Pepsi business in the North American marketplace." Should A-B InBev decide it doesn't want PepsiCo's snack business, it could sell it to one of the many buyers who would be interested in the maker of Lays potato chips and Quaker oatmeal, Dibadj said. The brewer hasn't shied away in the past from complex deals that involved divestitures. A takeover of PepsiCo may have a better chance of adding to A-B InBev's earnings than a purchase of SABMiller, said Withagen at Kepler Cheuvreux. SABMiller has a higher valuation than PepsiCo and less room for margin improvement. "If you look at their history, those Brazilians have always liked self-help stories," Ian Shackleton, a London-based analyst at Nomura Holdings Inc., said in a phone interview. "SABMiller does not tick that box." One option that might is Coca-Cola Co., he said. There are potentially more "levers to pull in terms of cost-cutting" than at PepsiCo, which has already been trimming expenses amid pressure from activist investor Nelson Peltz, according to the analyst. Shackleton said the more likely scenario would be that 3G Capital buys Coca-Cola in conjunction with billionaire Warren Buffett, the soft-drink maker's largest shareholder and 3G Capital's partner on the more than $20 billion buyout of H.J. Heinz Co. last year. Then 3G Capital could sell the U.S. distribution business to A-B InBev. "When you look at the Coke distribution system, arguably this is probably the best distribution system of any fast-moving consumer goods company in the world," the analyst said. "You're in every country in the world apart from North Korea and Cuba. Couldn't you actually use that system to distribute other stuff? Beer is a very obvious starting point." Buffett said in June there was no chance of a buyout of Coca-Cola after David Winters, an investor in the $195 billion soft-drink maker, suggested he might be plotting one. A deal for either Coca-Cola or PepsiCo would be a big bet on a soda industry that has growth challenges of its own. Buying a smaller player instead such as Dr Pepper Snapple Group Inc., with a market value of $13 billion, would represent less of an all-in wager, said Shah of Albert Fried. The brewer could look at the faster-growing markets for energy drinks and single-serve coffee. Coca-Cola announced investments in both Monster, a $16 billion company, and $23 billion Keurig this year. "Why couldn't Anheuser-Busch do the same thing?" Shah said. A deal for either could be structured as some sort of joint venture with Coca-Cola, he suggested. Representatives for Atlanta-based Coca-Cola and Plano, Texas-based Dr Pepper declined to comment. Coca-Cola's recent agreement to buy 17 percent of Monster will shift distribution away from A-B InBev in the U.S. and Canada. The companies split the job now. Coca-Cola also has an option to boost its stake to 25 percent. The biggest hurdle to targets outside of the brewery world may be that A-B InBev is simply more comfortable sticking with beer. "The opportunity is still large enough in brewing to continue consolidation there," Philip Gorham, an analyst at Morningstar Inc., said by phone. "It's with other brewers that they'll get the most cost savings, that they'll be able to more closely integrate operations, distribution." While a Heineken takeover would add another strong brand to A-B InBev's beer line-up, it seems unlikely the company's founding family would be willing to sell after it rejected an offer from SABMiller and said it wants to keep the brewer independent, Gorham said. Diageo's Guinness brand provides another possibility that would move A-B InBev into the African beer market, where it currently has little presence. That deal may be too small to have a meaningful impact on A-B InBev's profit, though, and Diageo would also likely demand a hefty premium for that business, should it be willing to sell it at all. The $70 billion company generates about 20 percent of its revenue from beer. That leaves SABMiller. Andrew Holland of Societe Generale SA says it is "by far the most attractive target" for A-B InBev given its size, position in Africa and the potential cost savings of a deal. Gorham of Morningstar says a deal may cost too much and not be in the best interests of shareholders. The difference of opinion adds weight to the argument for at least considering some of the other big-deal options A-B InBev has. "The bottom line is you're always going to see these guys be extremely entrepreneurial," Shackleton of Nomura said. "Do they have a case book on Pepsi? I'm sure. Do they have one on Coke? Absolutely. Do they have one on SABMiller? Yeah, of course they do. At the right price, with the right opportunity, everything is of interest." Copyright 2014 stltoday.com. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.

Saved Enlarge Photo If Anheuser-Busch InBev can't grab the beer of its choice, it could settle for a Pepsi. With almost $90 billion in deals over the last 10 years, including the 2008 acquisition of the maker of Budweiser, no other beverage company spends like AB InBev does. Most of the speculation on the $170 billion beer behemoth's next move has focused on the industry's No. 2 brewer, London-based SABMiller. A company of A-B InBev's size and ambitions has other options though, including PepsiCo Inc. A-B InBev and its advisers have long studied whether a merger with the $142 billion soda and snacks company makes strategic and financial sense, said people familiar with the matter. However, no talks are happening now, no deal is imminent, and the scenario is among many it has looked at, one of the people added, asking not to be identified because the information is private. A-B InBev should think beyond the beer market, said Albert Fried & Co. That could put Monster Beverage Corp. or Keurig Green Mountain Inc., even further away from the brewer's core, on its radar. Either way, A-B InBev probably won't walk away empty-handed. The culture of A-B InBev is "really based on doing large deals, making big steps forward," Richard Withagen, an Amsterdam-based analyst at Kepler Cheuvreux, said in a phone interview. "It's all speculation what the next step will be. That there will be a next step seems pretty sure, given that I don't think this company wants to only manage the business and not expand it any further." Representatives for Leuven, Belgium-based A-B InBev, Purchase, N.Y.-based PepsiCo and London-based SABMiller declined to comment. Representatives for Corona, Calif.- based Monster Beverage and Waterbury, Vt.-based Keurig didn't respond to requests for comment. A takeover of SABMiller would be "boring," said Sachin Shah, a special-situations and merger-arbitrage strategist at Albert Fried. Regulators would likely force divestitures, and the cost savings from a combination wouldn't necessarily translate to increased value for shareholders, he said. "Why am I going to pay a higher multiple for more of a business that you're already in that's not necessarily growing?" Shah said by phone. "Anheuser-Busch should become a drinks business, rather than just alcohol and beer." A-B InBev and PepsiCo do know each other well, one of the people familiar with the matter said, citing the companies' bottling arrangement in Latin America. PepsiCo's soda and snacks businesses both hold appeal amid slowing profits in the beer space, the people said. Any deal between the two would have to be friendly. One driver for a takeover would be the potential cost and revenue benefits of selling beer and soft drinks through the same distribution system. A-B InBev and its Brazilian backers including 3G Capital billionaire Jorge Paulo Lemann could also improve profitability at PepsiCo like they did after purchasing Anheuser-Busch. Lemann and his two longtime business partners are holders of A-B InBev. "From a strategic perspective, it doesn't strike me as too, too crazy," Ali Dibadj, a New York-based analyst at Sanford C. Bernstein & Co., said by phone. "If you look at the strengths of ABI, they're very clearly around cost-cutting and distribution, particularly in a difficult volume environment like beer. I think those could be translated pretty directly to the Pepsi business in the North American marketplace." Should A-B InBev decide it doesn't want PepsiCo's snack business, it could sell it to one of the many buyers who would be interested in the maker of Lays potato chips and Quaker oatmeal, Dibadj said. The brewer hasn't shied away in the past from complex deals that involved divestitures. A takeover of PepsiCo may have a better chance of adding to A-B InBev's earnings than a purchase of SABMiller, said Withagen at Kepler Cheuvreux. SABMiller has a higher valuation than PepsiCo and less room for margin improvement. "If you look at their history, those Brazilians have always liked self-help stories," Ian Shackleton, a London-based analyst at Nomura Holdings Inc., said in a phone interview. "SABMiller does not tick that box." One option that might is Coca-Cola Co., he said. There are potentially more "levers to pull in terms of cost-cutting" than at PepsiCo, which has already been trimming expenses amid pressure from activist investor Nelson Peltz, according to the analyst. Shackleton said the more likely scenario would be that 3G Capital buys Coca-Cola in conjunction with billionaire Warren Buffett, the soft-drink maker's largest shareholder and 3G Capital's partner on the more than $20 billion buyout of H.J. Heinz Co. last year. Then 3G Capital could sell the U.S. distribution business to A-B InBev. "When you look at the Coke distribution system, arguably this is probably the best distribution system of any fast-moving consumer goods company in the world," the analyst said. "You're in every country in the world apart from North Korea and Cuba. Couldn't you actually use that system to distribute other stuff? Beer is a very obvious starting point." Buffett said in June there was no chance of a buyout of Coca-Cola after David Winters, an investor in the $195 billion soft-drink maker, suggested he might be plotting one. A deal for either Coca-Cola or PepsiCo would be a big bet on a soda industry that has growth challenges of its own. Buying a smaller player instead such as Dr Pepper Snapple Group Inc., with a market value of $13 billion, would represent less of an all-in wager, said Shah of Albert Fried. The brewer could look at the faster-growing markets for energy drinks and single-serve coffee. Coca-Cola announced investments in both Monster, a $16 billion company, and $23 billion Keurig this year. "Why couldn't Anheuser-Busch do the same thing?" Shah said. A deal for either could be structured as some sort of joint venture with Coca-Cola, he suggested. Representatives for Atlanta-based Coca-Cola and Plano, Texas-based Dr Pepper declined to comment. Coca-Cola's recent agreement to buy 17 percent of Monster will shift distribution away from A-B InBev in the U.S. and Canada. The companies split the job now. Coca-Cola also has an option to boost its stake to 25 percent. The biggest hurdle to targets outside of the brewery world may be that A-B InBev is simply more comfortable sticking with beer. "The opportunity is still large enough in brewing to continue consolidation there," Philip Gorham, an analyst at Morningstar Inc., said by phone. "It's with other brewers that they'll get the most cost savings, that they'll be able to more closely integrate operations, distribution." While a Heineken takeover would add another strong brand to A-B InBev's beer line-up, it seems unlikely the company's founding family would be willing to sell after it rejected an offer from SABMiller and said it wants to keep the brewer independent, Gorham said. Diageo's Guinness brand provides another possibility that would move A-B InBev into the African beer market, where it currently has little presence. That deal may be too small to have a meaningful impact on A-B InBev's profit, though, and Diageo would also likely demand a hefty premium for that business, should it be willing to sell it at all. The $70 billion company generates about 20 percent of its revenue from beer. That leaves SABMiller. Andrew Holland of Societe Generale SA says it is "by far the most attractive target" for A-B InBev given its size, position in Africa and the potential cost savings of a deal. Gorham of Morningstar says a deal may cost too much and not be in the best interests of shareholders. The difference of opinion adds weight to the argument for at least considering some of the other big-deal options A-B InBev has. "The bottom line is you're always going to see these guys be extremely entrepreneurial," Shackleton of Nomura said. "Do they have a case book on Pepsi? I'm sure. Do they have one on Coke? Absolutely. Do they have one on SABMiller? Yeah, of course they do. At the right price, with the right opportunity, everything is of interest." Copyright 2014 stltoday.com. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.

Souce http://www.stltoday.com/business/local/a2d22015-e860-51a8-a0e4-812eef15d12f.html

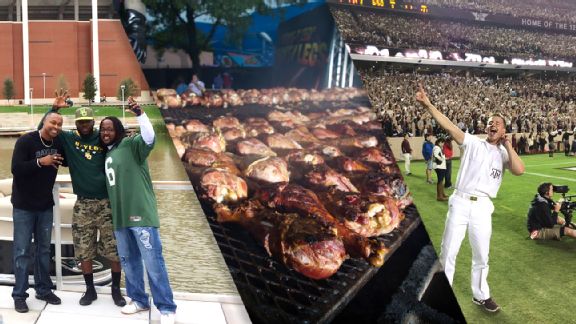

Diary of game day in Texas - ABC News

Atop the roof of the Waldorf Astoria Hotel, past planted basins of dinosaur kale and herbs, are six apiaries housing thousands of bees, all working hard to produce honey for the hotel's restaurants and spa treatments. While the honey comes in a limited quantity, only about 300 pounds were harvested from the rooftop this season, 50 pounds were dedicated to Empire Brewing Company upstate, to create a craft beer to serve at the Waldorf's Peacock Alley . But what makes a 120-year-old old school New York establishment start resembling a hip Williamsburg beer room? "We really like beer in the kitchen," Waldorf's executive chef David Garcelon said. A love for craft beer led to growing of hops in the rooftop garden this year, and with the addition of the honeybees, a new product was made. The Waldorf Buzz is a sweet brown ale at 6.5% ABV, which sips easily on its own but also pairs nicely with fall confections, like the Waldorf's golden honey macarons. While the hotel expects the kegs to only last six weeks, they're hoping to continue collaborating with Empire Brewering in the future, creating more seasonal products for New York's craft beer fans. Atop the rooftop garden at the beer's official launch last Wednesday night, Brewmaster Tim Butler (who was in tears at the honor of creating a signature brew for this iconic hotel: "We get emotional upstate"), checked out the chocolate mint growing on the rooftop, perhaps for a wintery beer concoction. For the next six weeks, or until the kegs run out, Waldorf Buzz will be pulled from the honey dripper taps for $9 drafts at the hotel bar. Waldorf Astoria Hotel bar, 301 Park Ave., 212-872-1275

Atop the roof of the Waldorf Astoria Hotel, past planted basins of dinosaur kale and herbs, are six apiaries housing thousands of bees, all working hard to produce honey for the hotel's restaurants and spa treatments. While the honey comes in a limited quantity, only about 300 pounds were harvested from the rooftop this season, 50 pounds were dedicated to Empire Brewing Company upstate, to create a craft beer to serve at the Waldorf's Peacock Alley . But what makes a 120-year-old old school New York establishment start resembling a hip Williamsburg beer room? "We really like beer in the kitchen," Waldorf's executive chef David Garcelon said. A love for craft beer led to growing of hops in the rooftop garden this year, and with the addition of the honeybees, a new product was made. The Waldorf Buzz is a sweet brown ale at 6.5% ABV, which sips easily on its own but also pairs nicely with fall confections, like the Waldorf's golden honey macarons. While the hotel expects the kegs to only last six weeks, they're hoping to continue collaborating with Empire Brewering in the future, creating more seasonal products for New York's craft beer fans. Atop the rooftop garden at the beer's official launch last Wednesday night, Brewmaster Tim Butler (who was in tears at the honor of creating a signature brew for this iconic hotel: "We get emotional upstate"), checked out the chocolate mint growing on the rooftop, perhaps for a wintery beer concoction. For the next six weeks, or until the kegs run out, Waldorf Buzz will be pulled from the honey dripper taps for $9 drafts at the hotel bar. Waldorf Astoria Hotel bar, 301 Park Ave., 212-872-1275

Souce http://www.amny.com/eat-and-drink/waldorf-astoria-honey-beer-waldorf-buzz-available-now-1.9497593

Could Pepsi quench A-B InBev's thirst for a megadeal? : Business

That was the mission. In the morning, one of the sport's great rivalry games: Texas vs. No. 11 Oklahoma at the Cotton Bowl in Dallas. Afternoon brought No. 9 TCU vs. No. 5 Baylor in Waco, a series played 109 times without both teams ever being ranked at the same time until now. Then for the nightcap, a new SEC West rivalry, No. 3 Ole Miss vs. No. 14 Texas A&M in College Station. Three of the nation's best college football games, all within 200 miles in a neat line from north to south. A challenge just too good to pass up. So we boarded the ESPN DIRECTV bus and made the nearly 16-hour voyage from game to game to game. The following is a diary of the sights and the sounds, the atmosphere and the action. Dallas: Texas-OU, corn dogs and turkey legs 8:30 a.m.: The day begins the only way it can: with a warm corn dog in hand. David Dixon, a 60-year-old Sooner living in Dallas, has figured this out in his 30-plus years of visiting the State Fair of Texas: You must strike early when the oil's hottest. "You've gotta get the one with the first grease," Dixon said. "That's the best corny dog." Dixon's uncle, the late Tommy Gray Jr., played halfback on OU's 1950 national title team. This isn't his first Red River rodeo. "This is the greatest experience in the world," he proclaims. 9:05: Texas' team bus rolls up to the Cotton Bowl behind a three-motorcycle escort, under overcast skies. Strength coach Pat Moorer, easily the scariest of the Longhorns coaches, is the first off the bus. Each Longhorns player, dressed in their mandatory blazers, khaki pants and burnt orange ties, fist-bumps Mark Evans as they step onto the fairground. It's his first year as the Longhorns' bus driver, and his first foray into the fair was a smooth one. "The team was quiet," Evans said. "Focused. All business." 9:20 a.m.: Tyrone Swoopes Sr. steps up to a Fletcher's Corny Dogs booth and orders his first corny dog, which he smothers in mustard. He's wearing a black hoodie, gray sweatpants and not one hint of worry about his son. "I'm excited for Tyrone," he said. "I saw him last night. He's focused. He had a different persona about himself. He's seen the big stage. He knows what he has to do." Cousin Byron Westmoreland, by his side, predicts Katy Perry will ask for Swoopes' number after this game. 9:34: A group of college guys engage in a priceless economics discussion at the ticket booth. One asks whether 40 tickets is enough. "No!" His buddy claims the cheapest beer at the fair costs 14 tickets. No way will 40 cut it. One brags about the year he bought 200. Their buddy at the front says he dropped $80 on tickets. They all agree that's good. Page

That was the mission. In the morning, one of the sport's great rivalry games: Texas vs. No. 11 Oklahoma at the Cotton Bowl in Dallas. Afternoon brought No. 9 TCU vs. No. 5 Baylor in Waco, a series played 109 times without both teams ever being ranked at the same time until now. Then for the nightcap, a new SEC West rivalry, No. 3 Ole Miss vs. No. 14 Texas A&M in College Station. Three of the nation's best college football games, all within 200 miles in a neat line from north to south. A challenge just too good to pass up. So we boarded the ESPN DIRECTV bus and made the nearly 16-hour voyage from game to game to game. The following is a diary of the sights and the sounds, the atmosphere and the action. Dallas: Texas-OU, corn dogs and turkey legs 8:30 a.m.: The day begins the only way it can: with a warm corn dog in hand. David Dixon, a 60-year-old Sooner living in Dallas, has figured this out in his 30-plus years of visiting the State Fair of Texas: You must strike early when the oil's hottest. "You've gotta get the one with the first grease," Dixon said. "That's the best corny dog." Dixon's uncle, the late Tommy Gray Jr., played halfback on OU's 1950 national title team. This isn't his first Red River rodeo. "This is the greatest experience in the world," he proclaims. 9:05: Texas' team bus rolls up to the Cotton Bowl behind a three-motorcycle escort, under overcast skies. Strength coach Pat Moorer, easily the scariest of the Longhorns coaches, is the first off the bus. Each Longhorns player, dressed in their mandatory blazers, khaki pants and burnt orange ties, fist-bumps Mark Evans as they step onto the fairground. It's his first year as the Longhorns' bus driver, and his first foray into the fair was a smooth one. "The team was quiet," Evans said. "Focused. All business." 9:20 a.m.: Tyrone Swoopes Sr. steps up to a Fletcher's Corny Dogs booth and orders his first corny dog, which he smothers in mustard. He's wearing a black hoodie, gray sweatpants and not one hint of worry about his son. "I'm excited for Tyrone," he said. "I saw him last night. He's focused. He had a different persona about himself. He's seen the big stage. He knows what he has to do." Cousin Byron Westmoreland, by his side, predicts Katy Perry will ask for Swoopes' number after this game. 9:34: A group of college guys engage in a priceless economics discussion at the ticket booth. One asks whether 40 tickets is enough. "No!" His buddy claims the cheapest beer at the fair costs 14 tickets. No way will 40 cut it. One brags about the year he bought 200. Their buddy at the front says he dropped $80 on tickets. They all agree that's good. Page

Souce http://abcnews.go.com/Sports/diary-game-day-texas/story?id=26159837

No comments:

Post a Comment